Volatility is one of the most important factors in technical analysis. Many novice and even professional traders very often underestimate its importance. In many cases a novice trader is looking for a perfect indicator that would deliver him or her nice profit without even thinking that if the stock market would be that simple than everybody would be the winner. In other cases many novice traders come to the market as a result of some system's advertising on TV, media or internet by hoping that some magic indicator with universal settings will make them rich in very short period of time.

Statistic shows that when somebody becomes an active trader, in most cases, he or she loses an entire portfolio in very short period of time. Does it mean that people should stop investing? - Not at all. It only underlines the importance of the stock market education before jumping into the complexity of the stock market analysis.

When it comes to the technical analysis, as was already mentioned above, the volatility, the same as price and volume is one of the very important factors in describing and evaluating the price movements. The importance of volatility lies not just in trading signals generation, but also in evaluating the trend conditions. The knowledge of how volatile price movement is could be strong tool in avoiding high losses and increasing the profitability of trading.

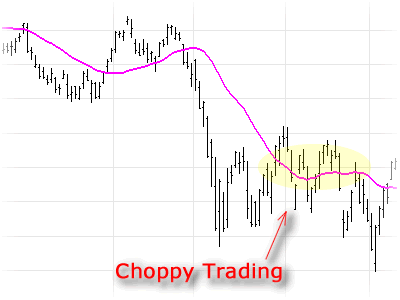

Did you ever run into situation when your technical indicators or your trading system that performed quite well in the past started to generate fake trading signals when it is either too late or too early to open or to close a trade. Did you ever have periods when your system started to generate choppy signals which (if you follow them) would wipe out all previously earned profit?

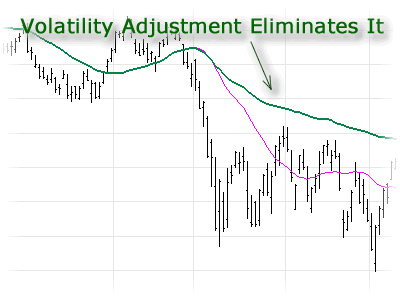

Wouldn't it be amazing if you have the possibility to adjust your indicators to the changing market conditions and avoid negative trading that could be suicidal to your portfolio? In reality, volatility analysis delivers such possibility. Volatility allows you to see when a trend tends to change its direction faster (higher volatility) and when you need to adjust your trading system either to avoid choppy trading or to catch up with all changes in trend. At the same time, the volatility analysis will tell you when a price trend becomes slower in changing a direction (lower volatility) and when there could be recommended to increase a lag to avoid too early and too late trading.

On the chart above you may see a simple example of adjusting to the volatility one f the simplest indicators in technical analysis - a moving average. During a stock decline, price usually becomes more volatile. In order to avoid choppy trading, bar period of this moving average could be increased. When volatility goes down - price movements become less choppy - our moving average's bar period can be adjusted back. It is clear and straightforward - knowledge of the market condition provided by volatility analysis is essential tool for a trader who wants to improve his/her portfolio performance.

Naked options trading is very risky - many people lose money trading them. It is recommended contacting your broker or investment professional to find out about trading risk and margin requirements before getting involved into trading uncovered options.